What Is a Crypto Oracle? Bridging Blockchain Reality

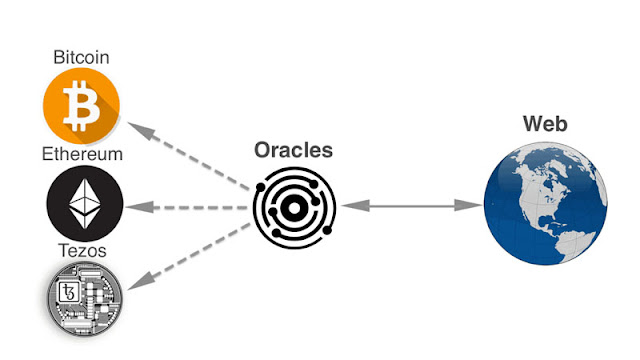

Blockchains like Ethereum are wizards at trust and math, but they’re blind to the real world—stock prices, weather, election results. That’s where crypto oracles swoop in, feeding outside data to smart contracts. In 2025, they’re the unsung heroes of DeFi, NFTs, and more. Let’s dive into what oracles are, how they work, and why they’re a big deal.

|

| Source: linkedin |

What’s a Crypto Oracle?

An oracle’s a middleman—software or hardware that grabs real-world info (like BTC’s price or a sports score) and pipes it into a blockchain. Smart contracts—say, a bet on ETH hitting $3K—can’t Google it; they’re locked in their own bubble. Oracles bridge that gap, making blockchain apps dynamic and useful beyond crypto-to-crypto swaps.

How They Work

It’s a relay race: an oracle pulls data from APIs, websites, or sensors—think Coingecko for prices, WeatherAPI for rain stats. It verifies it (often via multiple sources), then signs and sends it on-chain. A smart contract grabs it—say, paying out if BTC tops $60K—and executes. Speed’s key; Chainlink’s sub-second feeds dominate 2025’s DeFi scene.

Types of Oracles

Not all oracles are the same—here’s the lineup:

- Centralized: One source, like an exchange API—fast, but a single point of failure.

- Decentralized: Networks like Chainlink tap many nodes—trustworthy, tamper-proof.

- Input: Feed data in—price ticks, IoT stats.

- Output: Push blockchain results out—trigger a bank payment.

- Computation: Crunch numbers off-chain—complex math for dApps.

Decentralized rules—$15B+ in DeFi relies on it, per DefiLlama.

Big Names in 2025

Oracles power the ecosystem—here’s who’s hot:

- Chainlink (LINK): Kingpin—$7B+ market cap, 1,000+ integrations (Aave, Synthetix).

- Band Protocol (BAND): Cross-chain, cheaper—$500M locked in Cosmos, BSC.

- API3: Direct API feeds, dAPI focus—rising star.

- Pyth Network: Solana’s go-to, sub-second data—$2B+ in trades.

Chainlink’s the gold standard—80% of DeFi oracles lean on it.

Why They Matter

No oracles, no action—$200B+ in DeFi (2025 TVL) needs prices for lending, swaps, insurance. NFTs use them for rarity or auctions; prediction markets like Polymarket bet on election odds. Oracles unlock blockchain’s real-world potential—think crop insurance paying out via weather feeds.

The Risks

Oracles aren’t bulletproof. Centralized ones can lie—hacks like 2022’s Mango Markets ($100M lost) prove it. Even decentralized nets falter—bad data from one node can skew a contract. Costs bite too—Chainlink’s $0.10-$1 per call adds up. Check X or CoinDesk for outage buzz.

How to Use Them

Devs tap oracles via APIs—Chainlink’s docs on chain.link are gold. Users? You’re indirect—swap on Uniswap, odds are Pyth or LINK’s feeding it. Hodling LINK or BAND? Stake or run nodes for rewards—$50-$500 monthly if you’ve got the tech chops.

The Oracle Edge

Crypto oracles are blockchain’s eyes and ears—vital for 2025’s $3T+ market. They’re not sexy, but without them, DeFi’s dead, NFTs stall, and smart contracts stay dumb. From Chainlink’s reign to Pyth’s speed, they’re the glue tying crypto to reality—quietly running the show.